In this post, we will guide you through a simple and effective way to calculate Customer Lifetime Value that doesn’t require any fancy modeling or machine learning.

One of the holy grail metrics for any business is Customer Lifetime Value (CLV, aka LTV). With sufficient data, you can place a dollar value for any of your customers, no matter what purchase funnel stage they are in, and consequently prioritize your actions based on it. Understanding CLV can also help you see the financial benefits, as retaining customers for longer periods can lead to increased revenue and profitability, ultimately saving you money. The more data you have the more you can segment your customers which leads to a more accurate measure of CLV — for example, customers from different channels like Facebook ads or Google organic search; could have drastically different values.

Here are just a few things you can do with an accurate CLV:

- Prioritize your most valuable customers and keep them happy

- Double down on profitable acquisition channels (and scale down unprofitable ones) by comparing CLV to your customer acquisition costs (CAC)

- Personalize offers and campaigns based on different CLV tiers

Customer loyalty plays a significant role in determining customer lifetime value, as loyal customers tend to have higher lifetime values. At the end of this post we will share some tips for rewarding new customers and optimizing your marketing efforts to grow customer lifetime value.

By the end of this post, we hope you will have developed some basic intuition about CLV that you can start incorporating into your own store and operations. This guide assumes you’ve made a backup of all your Shopify data, or have some way to access the metrics and values we describe here. For everyone else you can get these for free for your store with our Shopify customer analytics app Segments.

Without further ado, here’s the formula:

The Customer Lifetime Value Formula

CLV = Existing Customer Equity + Future Customer Equity

= (Total Past Sales) + [(Avg Order Value) * (Avg Number of Orders) * Max(0, (Avg Tenure - Current Tenure))]

Easy, right!? We’ll break each component down in the following section to make sure we have a thorough understanding of how to calculate Customer Lifetime Value, as well as double-check our assumptions.

Aside: How is this calculation of CLV different from Shopify's Customer Lifetime Value blog post from a while back? Shopify's CLV is calculated on at a segmented level based on RFM scores (Recency, Frequency, Monetary), with a simplified guide and walkthrough using Shopify exports and spreadsheets. It's a more top-down approach based on different RFM segments. Our CLV calculation, in contrast, is a more bottoms-up approach that calculates CLV at an individual level (albeit using some top-down averages) and doesn't require any initial segmentation. Both work fine, the key is understanding the different components and assumptions being made.

CLV Components

Existing Customer Equity

What we call “customer equity” is really just how much a customer has already spent with your store. If a new signup has yet to purchase anything, then this value is $0. If a customer has spent $100 with you, then this value is $100. We include this base “customer equity” value to make sure high spending customers are properly accounted for, and skew towards new “hot” customers who are just beginning to spend.

Customer Equity = Total Sales

Average Order Value

Average order value, or AOV, should already be one of your core metrics. This metric represents exactly its name: the average dollars spent across all orders for a customer or customer segment. One thing to note is that this value— as well as the next metric, Average Number of Orders— is defined across a specified period of time to which we will need to normalize.

Average Order Value = (Total Sales) / (Total Number of Orders)

Average Number of Orders

In ecommerce data science parlance this metric is also known as “Frequency” — for the time period we care about, what is the average number of orders that a customer in a particular segment will purchase. You can average the number of orders across as large or small of a customer segment as you’d like; for starters we can just take all customers from your store. This number is useful when assessing your customer loyalty, or to measure the impact of additional Klaviyo flows. Remember that increasing frequency can lead to more money for your business, as loyal customers tend to continue to spend more over time.

Average Number of Orders = (Number of Orders) / (Number of Customers)

Average Tenure

Tenure can have several different definitions; the one we use is the length of time between a customer’s first and last order dates, normalized to the period of time you are using. We don’t use a customer’s account creation date (because what if they never buy anything?) and we also don’t use an indefinite end date (churn and churn win-back is a separate topic that we will discuss in a later post). A user that never buys anything is not counted, and a customer that only purchases 1 order has a tenure of 1 day. How do we know when a customer has purchased their “last” order? We can never be sure, but we can use a reasonable cutoff like “1 year since last purchase”. The average tenure, then, is the average (normalized) number of days between a customer segment’s first and last order dates.

Average Tenure = (Total Customer Tenure) / (Number of Customers)

Current Tenure

For existing customers, like we mentioned above, we don’t actually know when their “last” order will be, but we can continue using our cutoff of 1 year. We use a slightly modified definition of tenure for “current tenure” which is the length of time between today’s date and the most recent order date (normalized). This modification makes sure we weigh recently purchased customers more highly, as intuitively they are more likely to keep coming back (in most cases).

Current Tenure = (Current Date) - (Most Recent Order Date)

Note that when the existing tenure is greater than the average tenure, then we'll get a negative value for (Avg Tenure - Existing Tenure); hence the Max(0, …) to make sure we just use a 0 value and assume the customer has churned.

Other Factors Affecting Customer Lifetime Value

Aside from the above, other factors do impact CLV, including:

- Core Product or Service: The quality of product or service can significantly impact customer satisfaction and loyalty. Companies that deliver exceptional goods or services tend to have higher customer lifetime values.

- Net Promoter Score (NPS): NPS is a measure of customer satisfaction and loyalty; it can be a more direct way to measure quality of product and/or service.

- Customer Acquisition Costs: While not discussed here, the cost of acquiring a new customer can be included in calculations of lifetime value, which would be closer to something like "customer lifetime profit". Companies that can reduce acquisition costs while maintaining a high level of customer satisfaction would have higher "lifetime profit".

Putting It All Together

Now we can put all the component pieces of CLV back together to our formula: In plain English, we can say that the Customer Lifetime Value for a given customer in a segment (could be your entire store) is a customer’s existing spend, plus the expected average spend spread out across the average remaining number of days the customer is expected to be an active shopper.

CLV = Existing Customer Equity + Future Customer Equity

= (Total Past Sales) + [(Avg Order Value) * (Avg Number of Orders) * Max(0, (Avg Tenure - Current Tenure))]

How to Grow Customer Lifetime Value (CLV).

Looking to improve your CLV? Here's a look at some of the most common tactics. Hopefully by understanding these you can both grow your store & develop a better understanding of the concepts of Customer Lifetime Value.

- Personalization: Use data and AI using the Segments app for Shopify to create hyper-personalized experiences for each customer. Recommend products they'll love, send them tailored offers timed at the exact right moment, and make them feel like you know them better than they know themselves. It's like having a personal shopping assistant in their pocket!

- Subscription: Introduce a subscription model that keeps customers coming back for more. Whether it's a monthly box of goodies, auto-replenishment of their favorite products, or access to exclusive content, make it appealing they can't help but sign up and stick around.

- Loyalty Program: Treat your most loyal customers like royalty with an exclusive VIP program that offers personalized perks, early access to new products, and special discounts. Make them feel so valued, they'll never want to shop anywhere else. Loyalty programs are ubiquitous in America and repeat purchasers even expect them as a reward for their business.

- Effective Management: Implement effective management strategies to improve customer retention and reduce churn. By ensuring smooth operations and addressing employee turnover, you can enhance overall efficiency and create a better customer experience.

What is a High Customer Lifetime Value?

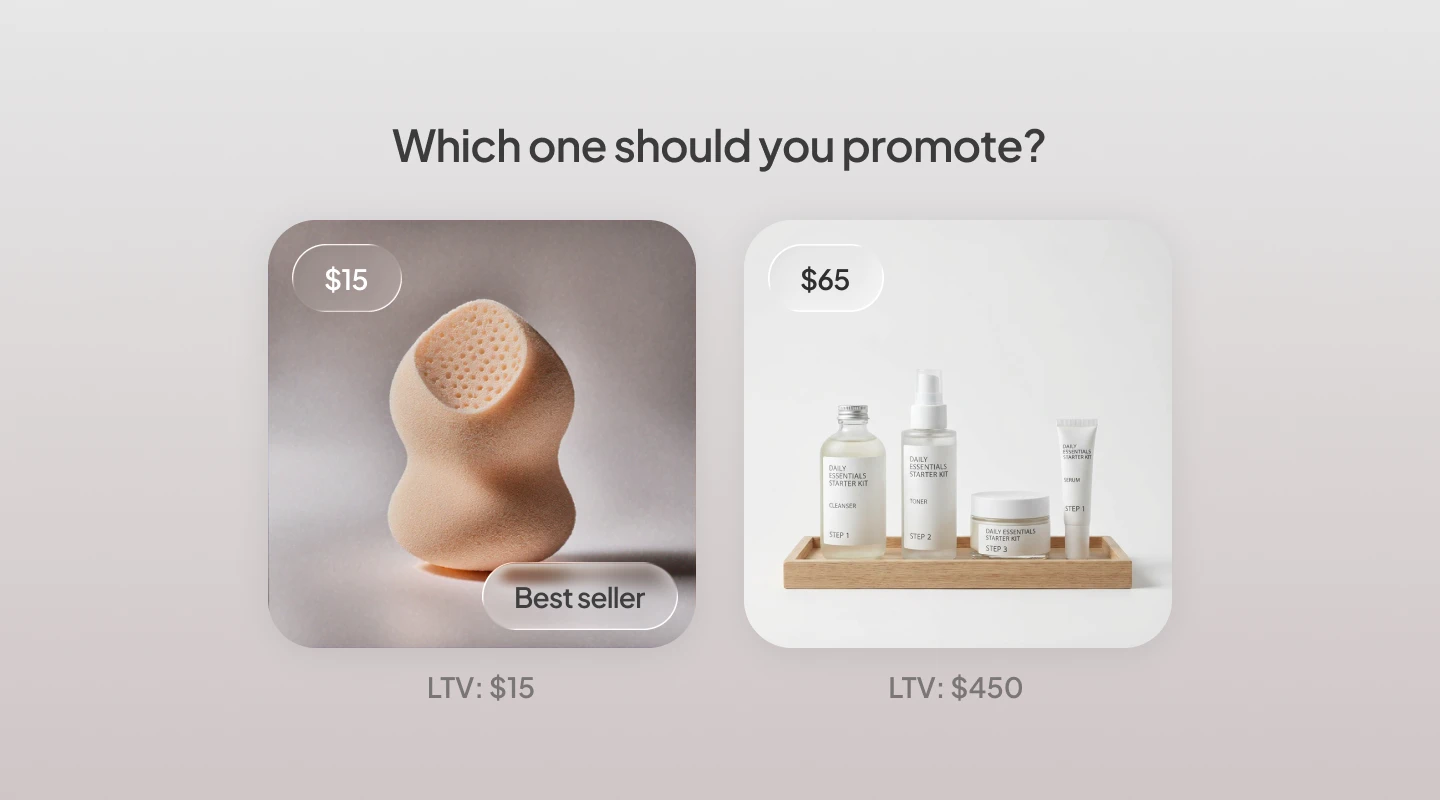

This can vary a lot depending on your industry or business model. For companies who sell high-priced, typically one-off purchases like furniture, a high CLV customer may simply have a high AOV but low frequency. However, a subscription company in the cosmetics or pet care industry may have an even higher CLV made up of many purchases over many years. Generally speaking it's hard to compare CLVs across disparate companies. However in advertising, the ratio between CLV and CAC (customer acquisition cost) can be extremely important.

Questions? Hit us up in the comments or team@tresl.co.